I bought Trump stock 30 minutes before it crashed. This is why I'm not panicking (yet)

My first foray into investing hasn't been the calmest. The best I can do is wait until Wednesday - or rely on this unlikely lifeline.

At the end of October, I finally bit the bullet and invested a sizable amount of my savings into the stock market. Never to do anything right away, I did this after reading several books, listening to a few podcasts, and taking the appropriate measures via help from my bank.

I decided that I would split my assets into several options with roughly 15% of my assets in cryptocurrencies and the remaining 85% in more traditional stock.

My stocks vary between banking, finance, weapons manufacturing, and semiconductor companies. While I was a bit biased toward Israeli companies, my portfolio also includes American and Taiwanese companies.

There’s one asset I want to discuss here today: the 5% of my portfolio dedicated to Trump Media & Technology Group - shortened to DJT 0.00%↑ hereafter.

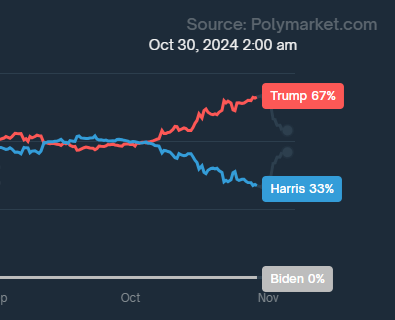

The stock has been extremely volatile ahead of the election next week and I decided to take a gamble on it: The company, in which President Trump owns roughly a 56% stake, saw some massive gains throughout October when the former president was given a 67% chance of winning the presidency (see below as reflected on betting market site Polymarket.

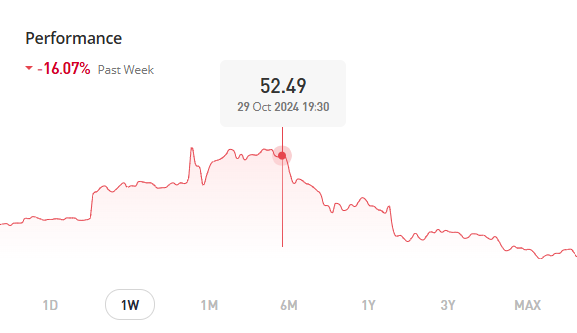

His odds were therefore reflected in the stock, as seen here the day before on eToro:

I decided to invest some money into the possibility that he would win and I could make some easy cash in a few short days. However, as you can see, the stock quickly took a tumble soon after October 30 and the stock has since dropped a massive 16% in the last week.

Ok, so not my finest first hour in the investment business. There are a few reasons why this may have happened.

DJT 0.00%↑ has always been volatile and this is the latest in a long line of ebbs and flows (the stock is still up 108% since this time last year)

Sentiment towards Trump changed soon after comedian Tony Hinchcliffe made distasteful jokes about Puerto Rico, Jews, and other groups during the infamous MSG event in NY

Recent polling has Trump and Harris effectively tied, removing confidence in his win

Some may say that investing in DJT 0.00%↑ at all was a mistake, and especially unwise to do so at what appears to be its most recent peak. And right now I wouldn’t disagree. I must admit it feels rather painful to be sitting on such a loss so early into my investing game, but I have reassurance knowing the rest of my traditional assets are all performing quite comfortably.

I also have the added benefit of an incredibly patient and supportive wife who keeps reminding me to look at the long game and how we haven’t lost the money until I decide to sell the stock.

But I’m not sure I will. Sure, if he wins we are hoping for a large rise in value and that may be attractive, but there is another reason to hold on to it even if he loses (personally I don’t think he will, which is what motivated my initial purchase).

According to TipRanks:

There is media speculation that Elon Musk might buy Trump Media & Technology Group and absorb the social media company into X (formerly Twitter).

The New York Post is reporting that people within Donald Trump's business and political camps think there's a chance that Musk will acquire Trump Media, which operates the Truth Social platform that is a clone of X that Musk already owns.

Trump, the former U.S. president who is running for re-election, owns 56% of the social media company that is named after him and whose ticker symbol is his initials. The former president has said repeatedly that he has no plans to sell his stake in Trump Media.

But the Post is quoting unnamed sources saying that a combination with X would make sense.

If President Trump loses the election and this news ends up being true, then perhaps it might be worth holding on to the stock. I’ll be honest, I have no idea if this initial purchase was wise (it likely wasn’t), and I have no idea if DJT 0.00%↑ has a lifeline after Tuesday (it likely doesn’t), but it is interesting to consider the future of the media landscape and whether this news is true or not.

And besides, this has been an incredibly exciting and informative first week in my new era of being an ‘investor’.

Do you have any experience trading stock? What is your portfolio looking like in the days leading up to the election? I’m pretty new to this so I would be interested in hearing any tips, tricks, or advice.

As of November 3:

Trump’s chances of winning have dropped from 67% to 53.7%:

All the last polling have the candidates at effectively a dead-heat tie, according to 538.